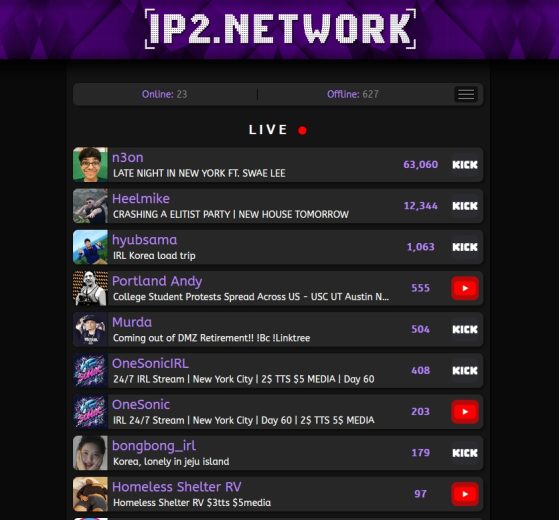

IP2.Network is a leading online platform that serves as a hub for real-time streaming content. It offers a diverse range of content from both IRL (In...

IP2.Network The Hub for Real-Time Streaming Content

IP2.Network is a leading online platform that serves as a hub for real-time streaming content. It offers a diverse range of content from both IRL (In...

Solved Driver WUDFRd failed to load: WudfRd driver failed to load is caused because of incompatible drivers which usually occurs when you upgrade to Windows 10. This is...

Horriblesubs, a once beloved anime subtitle provider, had a remarkable journey within the anime streaming community. With its quick and high-quality subtitle...

Notepad++ is a versatile text and source code editor specifically designed for Windows. It offers a wide range of features and functionalities that make it a...

Every day, new companies open their doors, offer jobs, and drive economies. There is no doubt that small businesses are the backbone of a nation. But that...

LiveTV is a free website where you can watch sports and games from all over the world as they happen. LiveTV lets you watch sports and games from all over the...

Looking for a way to enjoy unblocked gaming and entertainment online? Look no further than ClassWork.cc. This leading online resource offers a wide range of...

Best StreamEast Live Alternatives Free Sports Streaming Sites: StreamEast’s entertainment service broadcasts live sports events for free. There are...

SkinPort is the ultimate marketplace for CS:GO (Counter-Strike: Global Offensive) skins, offering gamers a secure and user-friendly platform to buy and sell...

Are you tired of dealing with cluttered and disorganized files on your Android device? Look no further! Introducing Cx File Explorer, the versatile file...

Microsoft will begin offering Windows 10 Update v1903 shortly now, and I am confident that the majority of you have to be excited about installing it as soon...