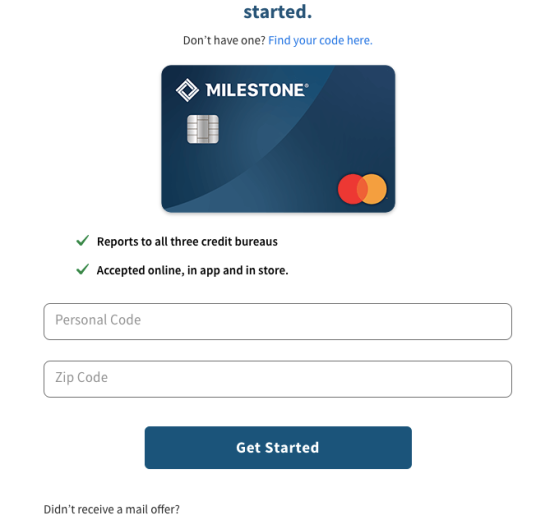

Learn how to easily access and manage your Milestone credit card online by following these step-by-step instructions. Logging into your Milestone...

How To Login Into Milestone Credit Card Online Account 2024

Learn how to easily access and manage your Milestone credit card online by following these step-by-step instructions. Logging into your Milestone...

This article explains Investment Apps For Android. Money makes money, and you must make your money work for you. You can enhance your fortune and live like a king by...

This article explains iCloud Drive Alternatives for iPhone and Mac. Even nearly a decade after its launch, iCloud still only offers 5GB of free cloud storage...

The best way to manage and deliver projects successfully for organizations is to invest in right project management software. The combination of robust project...

Best Proxify Alternatives will be discussed in this article. Proxify is a popular proxy website that enables users to access web-based and block content...

Ways To Fix Depop OAuth2 Error will be described in his article. Depop is a peer-to-peer social marketplace where you can buy & sell goods, most of which...

Best Leiaai Alternatives will be discussed in this article. Vybe Software LLC is the developer of the digital experience maker software, Leia A.I. This tool...

Why Is Cryptocurrency Important will be described in this article. Cryptocurrencies are no longer considered “niche” forms of payment. Despite the...

Best Divjoy Codebase Alternatives will be discussed in this article. When it comes to authentication, data gathering, payments, billing administration...

Best Gorillapdf Alternatives will be described in this article. With the help of the 2020 launch of GorillaPDF, users can convert documents and images into PDF...

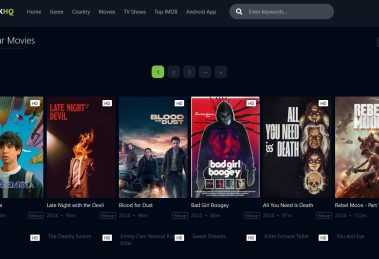

LookMovie is the ultimate destination for streaming movies online. Whether you’re a movie enthusiast or simply looking for a convenient way to watch your...